Manual payroll calculator

This free paycheck calculator makes it easy for you to. Running manual payroll may be costing you more than you think.

A Small Business Guide To Doing Manual Payroll

A W-4 form is an IRS form that documents an employees status so that the employer can.

. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. According to the IRS more than 40 percent of small and mid-size businesses get fined an average of 845 each year for payroll or taxation issues. Starting as Low as 6Month.

If overtime is included in manual payroll calculations it is paid at 15 times the workers regular pay rate. Discover ADP Payroll Benefits Insurance Time Talent HR More. Free Unbiased Reviews Top Picks.

Multiply the hourly wage by the number of hours worked per week. Use the Payroll Deductions Online Calculator PDOC to. How to calculate annual income.

Every single pay period your people are spending. Heres how it works and what tax rates youll need to apply. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Small Business Low-Priced Payroll Service. In 2014 more than 68 million. Each of your employees needs to fill out a W-4 form.

3 Months Free Trial. The help says to go to the Employees menu and click on Manual Payroll but there is. Ad Get Started Today with 2 Months Free.

How to Do Payroll Manually. This calculator can be used to project changes in deduction. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an.

Check your payroll calculations manually. Find out in 3 minutesdownload this Manual Payroll Cost Calculator. Get Started With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll. Rules for calculating payroll taxes.

The Ireland Payroll Calculator is designed to be intuitive but we feel it is always useful to have a step-by-step guide to using the calculator to ensure you the user get the most out of this tool. Gross wages are the total amount of money your employee earned during the current pay period. Ad Compare This Years Top 5 Free Payroll Software.

Ad GetApp has the Tools you need to stay ahead of the competition. All Services Backed by Tax Guarantee. Use this Cost of Manual Payroll Calculator to see the true cost of running manual payroll.

3 Months Free Trial. Then multiply that number by the total number of weeks in a year 52. Ad Compare This Years Top 5 Free Payroll Software.

Small Business Low-Priced Payroll Service. Plug in the amount of money youd like to take home. Ive got Accounting Standard 2008 and I am trying to access the Manual Payroll calculator.

The steps our calculator uses to figure out each employees paycheck are pretty simple but there are a lot of them. One of the most important skills when starting out in payroll is learning how to perform manual calculations of income tax PAYE. It will confirm the deductions you include on your.

Starting as Low as 6Month. Overtime for Hourly Workers. For example if an employee makes 25 per hour and.

Customized Payroll Solutions to Suit Your Needs. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. For businesses with more than a few employees manual payroll becomes a time-consuming frustrating undertaking.

You can use an online paycheck calculator to check. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Ad Process Payroll Faster Easier With ADP Payroll.

Income tax PAYE - Manual calculations. For example if an employee makes 25 per hour and. For all members of your workforce Paycom streamlines and automates HR and payroll tasks across the entire employee life cycle.

Ad Here When it Matters Most. TOTAL COST LOST ANNUALLY TO MANUAL PROCESSES. Find out in 3 minutesdownload this Manual Payroll Cost Calculator.

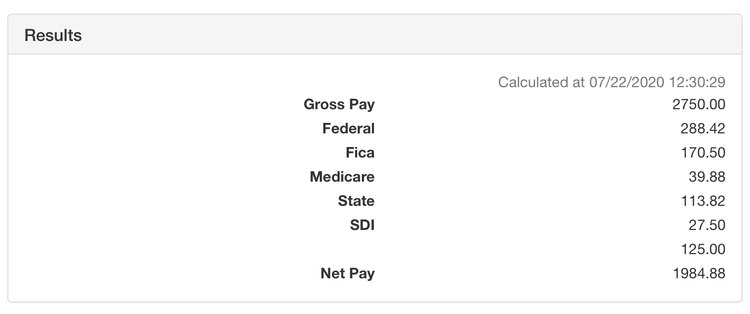

Read reviews on the premier Hours Tools in the industry. Gross-to-Net is a payroll calculator modeled after the actual payroll calculation program used for state employees pay warrants. Here When it Matters Most.

Get Started With ADP Payroll. Get Your Quote Today with SurePayroll. Payroll So Easy You Can Set It Up Run It Yourself.

Free Unbiased Reviews Top Picks. In this case the calculation would look like. Figure out each employees gross wages.

For example if an employee earns 1500. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. Heres a step-by-step guide to walk you through.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Here S A Quick And Smart Method Timecamp

The Cost Of Manual Payroll Human Error Calculator

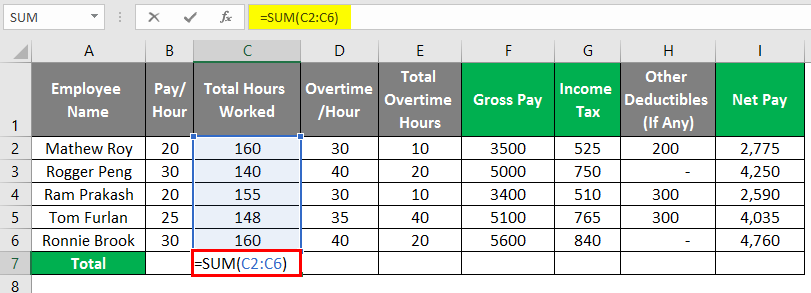

Payroll Formula Step By Step Calculation With Examples

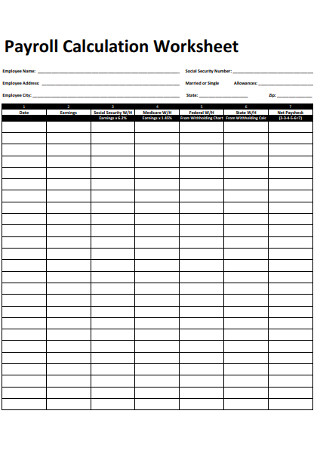

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel

How To Calculate Payroll Taxes Methods Examples More

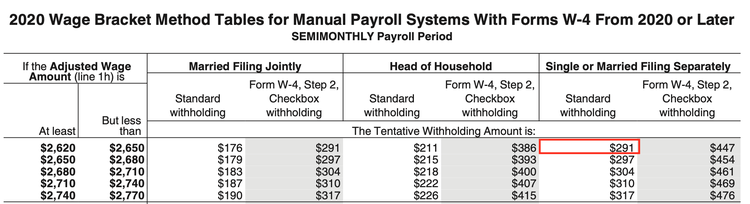

How To Calculate 2019 Federal Income Withhold Manually

How To Do Payroll In Excel In 7 Steps Free Template

Free 8 Sample Payroll Time Sheet Calculator Templates In Pdf Excel

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Payroll Calculator Free Employee Payroll Template For Excel

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Payroll For Hourly Employees Sling

Payroll In Excel How To Create Payroll In Excel With Steps

A Small Business Guide To Doing Manual Payroll