Determine cap rate

The cap rate formula is simple. States will be asked to submit a revised CAP by.

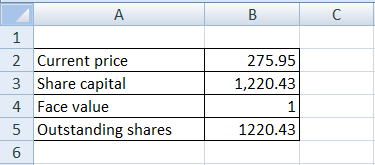

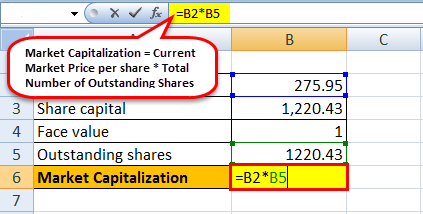

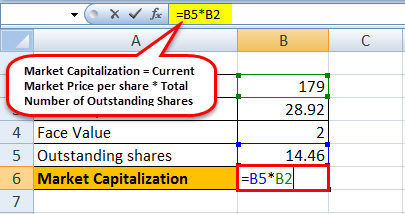

Market Capitalization Formula How To Calculate Market Cap

A commonly used valuation method combines income and the capitalization rate to determine the current value of a property being considered for purchase.

. The cap rate value will be automatically calculated for you. The cap rate is expressed as a percentage usually somewhere between 3 and 20. Comparing different cap rates in the neighborhood where you would like to invest is an excellent way to determine which properties.

In other words capitalization rate is a return metric that is used to determine the potential return on investment or payback of capital. What is Cap Rate Formula. Weekly benefit rate The amount of money you are.

Divide net operating income NOI by the property value or the purchase price. It projects the expected rate of return on the investment made. Read more is very simple.

The wages earned during your base year will determine the amount of weekly benefits you may receive and the total amount you can potentially receive throughout your claim. The most important thing to remember is that you. Better performance and better for the environment thats a Malarkey shingle.

The cap rate is calculated by finding the ratio of the net operating income to the current market value of the property. It helps investors determine if a property to be purchased is a good deal or it is overpriced. Essentially a lower cap rate implies lower risk while a higher cap rate implies higher risk.

Investors hoping for a safer option would therefore favor properties with lower cap rates. You use the reverse cap rate formula to arrive at a buying or selling price for a property. What is Capitalization Rate Cap Rate.

For multi-tenant investments especially opportunities where one is making a number of value-added improvements the cap rate is somewhat irrelevant because of the instability of the underlying cash flows. Determine your ideal investment strategy with a complimentary Investment Portfolio review. Simply enter your NOI and purchase price or market value.

We offer 3 different loan programs - Conventional Federal Housing Authority FHA and VA loans for veteransSimply select which program youre interested in. The cap rate calculator alternatively called the capitalization rate calculator is a tool for everyone interested in real estateAs the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting itYou can use it to decide whether a propertys price is justified or determine the selling price of a property you own. Or call us at.

Unlike standard shingles which prematurely become brittle crack and lose granules Malarkey shingles are made of Rubberized Asphalt for superior all-weather resilience Upcycled Rubber Plastics to reduce landfill waste and Smog-Reducing Granules that help clean the air. A propertys capitalization rate or cap rate is a snapshot in time of a commercial real estate assets return¹ The cap rate is determined by taking the propertys net operating income the gross income less expenses and dividing it by the value of the asset² Commercial real estate is an investment type so the return is a reflection of the risk and the quality of the. The reverse cap rate formula uses cap rate and NOI to calculate the market value of a property.

For example suppose you are trying to determine what you should offer on a property. Have a question about AAFMAAs CAP Loan. In addition to a propertys market value one of the first things youll want to do as a real estate investor whos considering buying a purchase is determine is its operating income and costs.

Leave a Comment Cancel Reply. The cap rate of a property is determined based on the potential revenue and the risk level as compared to other properties. Cap rate is both a measure that tells you how much you.

State Liaison to ensure that all CAP requirements are met After the initial review is complete states will receive one of two letters. The loan term is how long in years until the loan is fully repaid. On the flip side of the coin properties with a lower net operating income and.

Check out our FAQs for answers. A cap rate is calculated by dividing the Net Operating Income NOI of a property by the purchase price for new purchases or the value for refinances. As a general rule the formula will determine a higher cap rate for properties that have a higher net operating income and lower valuation.

Capitalization rate or Cap Rate for short is commonly used in real estate and refers to the rate of return on a property based on the net operating income NOI that the property generates. Debt service is the repayment of principal and interest on the mortgage used to purchase a commercial property and is typically expressed on an annual basis. To determine Cap Rate combine Net Operating Income and appreciation.

Cap rate is calculated by dividing the annual net operating income NOI by the property value. Check out our FAQs for answers. CRE professionals use cap rates to forecast the potential rate of return on an asset.

We use return on cost to determine if well potentially generate an income stream greater than what we could. Rakshit Bisht March 4 2021 - 811 am. Generally a longer-term loan works out to lower monthly payments and.

To determine a safe cap rate you must identify how much risk you are comfortable exposing yourself to. Or call us at. It is calculated by dividing the net operating income by the assets current market value and percentage.

Cap Rate 8. If you know the propertys NOI and have a cap rate goal you want to target then you can calculate what purchase price will give you the. Current Property Value NOI Cap Rate.

Clearly if you know or if you can estimate the NOI then the property value depends on the chosen cap rate. Capitalization rate or cap rate is a real estate valuation measure used to compare different real estate investmentsAlthough there are many variations the cap rate is generally calculated as the ratio between the annual rental income produced by a real estate asset to its current market valueMost variations depended on the definition of the annual rental income and whether it is. Cap rates generally have an inverse relationship to the property value.

Use the calculator below to calculate your cap rate. Learn more about CapCenters loan programs here. Cap rate is a metric that investors use to determine the expected rate of return based on the expected annual income of a property.

Cap Rate Limitations. EX net rental income is 18k and total cash cost is 300k. The formula for Cap rate or Capitalization rate Capitalization Rate Capitalization Rate is the rate that helps determining value of a real estate investment.

An acknowledgement letter stating that the CAP meets all requirements a letter advising what areas do not meet requirements and need to be addressed. Wage cap The earnings threshold by which workers contribute to Temporary Disability and Family Leave Insurance. After you choose a limiting key a limiting implementation can use it to track usage.

To enforce rate limiting first understand why it is being applied in this case and then determine which attributes of the request are best suited to be used as the limiting key for example source IP address user API key. In commercial real estate a capitalization rate cap rate is a formula used to estimate the potential return an investor will make on a property. Appreciation in your community is 2 per year.

How To Determine A Cap Rate Https Tgrocre Leadpages Co The Secret1 Capitalization Rate News Blog Commercial Real Estate

Cap Rate Calculator Shop 55 Off Www Wtashows Com

Cap Rate Calculator Free Online Calculation Free Online Capitalization Rate Calculator

Market Capitalization Formula How To Calculate Market Cap

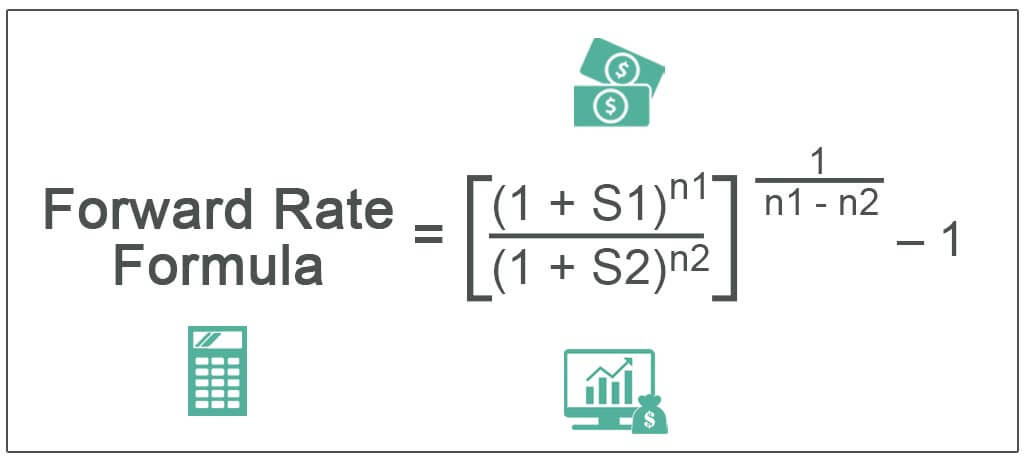

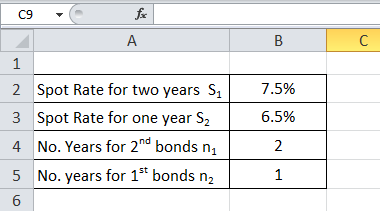

Forward Rate Formula Definition And Calculation With Examples

Forward Rate Formula Definition And Calculation With Examples

Easy Visual For Calculating Cap Rate Investing In A Rental Pre Construction Not All Projects Are The Same R Being A Landlord Investing Real Estate Investor

When You Know The Net Operating Income Of A Property And Divide It By The Cap Rate For Similar Properties Capitalization Rate Property Valuation Capitalization

Capitalization Rate Formula Top Sellers 53 Off Www Ingeniovirtual Com

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Buying Investment Property

Market Capitalization How Is It Calculated And What Does It Tell Investors

Market Capitalization Formula How To Calculate Market Cap

Market Capitalization Formula How To Calculate Market Cap

Pin On Airbnb

How To Figure Cap Rate 6 Steps With Pictures Wikihow Real Estate Investing Rental Property Rental Property Investment Real Estate Education

Forget Everything You Ve Heard About What Is A Good Cap Rate Investment Property In 2022 Real Estate Investing Rental Property Real Estate Investing Real Estate Tips

Understanding Cap Rates The Answer Is Nine Capitalization Rate Exam Answer Understanding